When the stock market lacks clear direction, options strategies can be a dependable friend. I often go through the OptionsPlay ChartLists in StockCharts to look for stocks that show potential trading or investing opportunities.

On Tuesday, as I was scrolling through the Bearish Trend Following Strategies in the OptionsPlay Strategy Center, using a balanced risk profile and max risk of $2,500 as the criteria, a long put on Boston Scientific Corp. (BSX) stock showed up on the list with a relatively high OptionsPlay score.

The closing stock price of BSX on Tuesday was $101.24 and was approaching its 50-day simple moving average (SMA), which could act as a resistance level. Its relative strength index (RSI) was hovering around 50, and the percentage price oscillator (PPO) was close to the zero line. Not much changed on Tuesday (see chart below).

FIGURE 1. DAILY CHART OF BSX STOCK. The stock price is approaching its 50-day SMA but momentum seems to be slowing as indicated by the relative strength index and percent price oscillator. Chart source: StockCharts.com. For educational purposes.The RSI and PPO indicate that momentum has slowed in the stock. So there’s a chance the stock price of BSX could hit the resistance of its 50-day SMA and fail to break above it, or it could break above it and continue higher. The short-term directional bias is neutral and could be a viable options trading candidate.

Let’s see what strategies the OptionsPlay Explorer comes up with for a bearish outlook on the stock price of BSX.

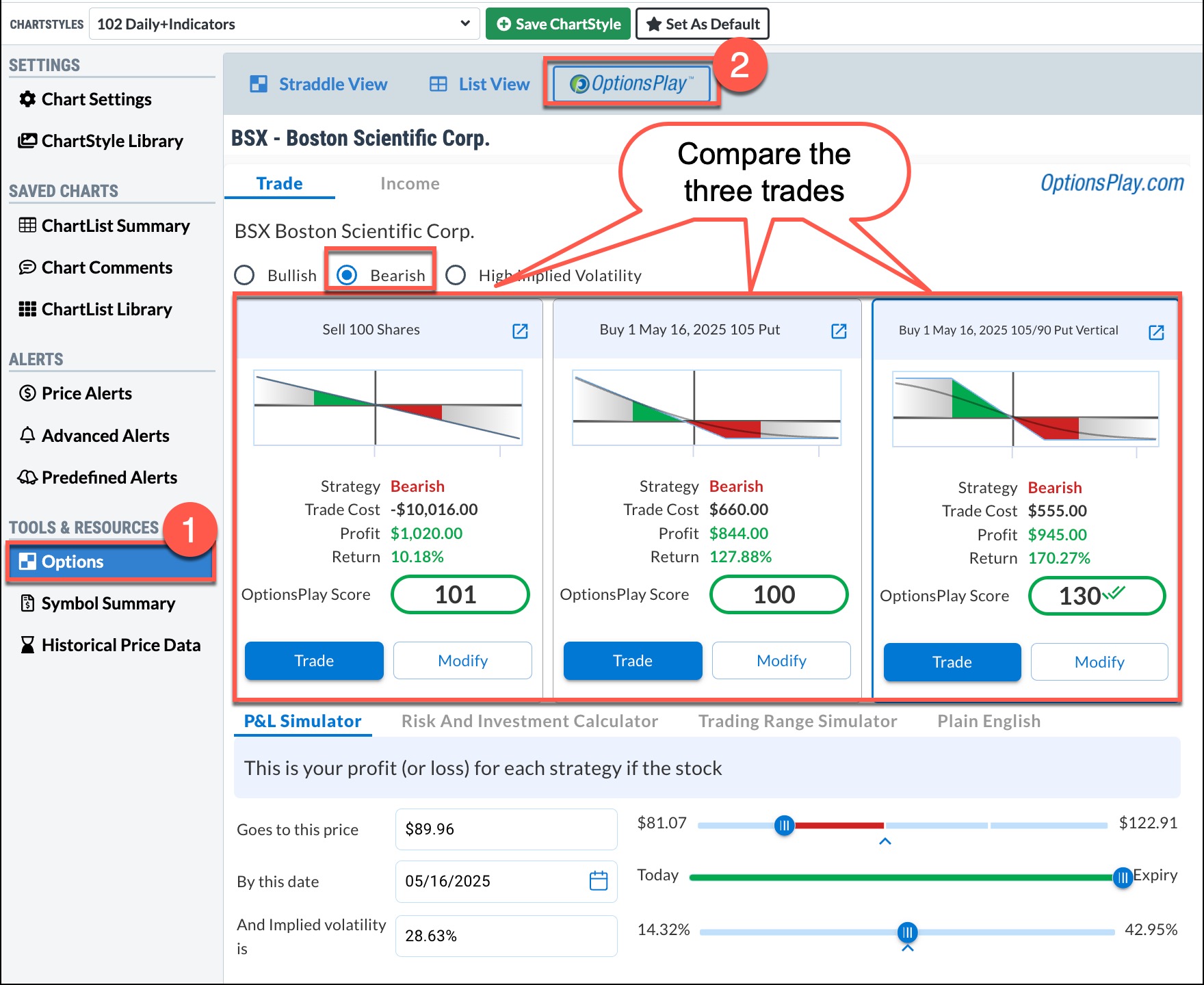

How to access OptionsPlay. In the SharpCharts workbench, select Options > OptionsPlay. Then compare the three optimal strategies.

FIGURE 2. OPTIMAL STRATEGIES FOR TRADING BSX FOR A BEARISH SCENARIO. Shorting BSX, buying a put, and a long put vertical are viable trading strategies for BSX. When selecting a strategy, select one that aligns with your comfort level. Image source: StockCharts.com.

The two options strategies with relatively high OptionsPlay scores are the May 16 105 put and the May 16 105/90 put vertical spread. If you shorted 100 shares of BSX instead of trading options on the stock, your return would have been lower (see left panel).

Both options strategies, i.e., the long May 15 105 put and the May 16 105/90 put vertical, look viable but a bearish move isn’t confirmed in the daily chart of BSX. There’s a chance the stock price of BSX will remain between $90 and $105 for an extended period (dashed blue horizontal lines). Because of the lack of directional clarity, I’d prefer to opt for the put vertical. You’re still buying the long put but adding a short put at a lower strike price with the same expiration date. This will offset the long put’s cost.

Your risk is limited to $555 with a potential reward of $945. The trade will be profitable if the stock price of BSX closes below $99.45 before the contract expires. As of this writing, there’s a 48.6% probability of this happening.

Remember, stock prices are dynamic so what you see today may not be the same as what you see tomorrow.

Keep the following points in mind:

- You’re considering a bearish strategy when the short-term trend is neutral.

- BSX reports earnings on April 30, which is before the options contract expires.

- Keep an eye on implied volatility since it can change significantly during earnings. It’s important to manage your open trade. There are many ways to do this. View our educational webinars to learn more about how to manage your option trades.

The Bottom Line

With tariff announcements looming, it’s probably a good idea to hold off placing trades until after we know what tariffs will be implemented. Things could change on Thursday and BSX’s stock price shows a clear upside or downside. Review the optimal strategies before placing an option trade, and only place a trade if you are comfortable with the risk-reward tradeoff.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.